|

|

Weekend Review: Pulling the String; Foxconn Shines; Autonomy, HP and Michael LynchBy Graham K. Rogers

It will be interesting to read Philip Elmer-DeWitt's score card later. It is only available to subscribers right now, but the introduction mentions that "once again the indies clobbered the pros". Why am I not surprised? I have also found some comments and questions from the conference call (below) including a breakdown of sales information. First, however, here are the main points from Apple's own release.

Apple today announced financial results for its fiscal 2022 first quarter ended December 25, 2021. The Company posted an all-time revenue record of $123.9 billion (more than General Motors makes in a year MacDaily News), up 11 percent year over year, and quarterly earnings per diluted share of $2.10.

Jason Snell (Six Colors) had some visual information too, but there were some important points in the general content: "Mac revenue also reached a new all-time high at $10.9 billion, and iPhone revenue also peaked at $71.6 billion. The iPad's revenue was $7.2 billion, down sequentially and year-over-year, but still among the five best iPad quarters in recent years." He add that "Services kept its upward growth path, setting a new record at $19.5 billion, and Wearables/Home/Accessories likewise set a new record at $14.7 billion." Evan Selleck (iDownloadBlog) broke down some of the figures into an easily-digestible list, adding general comments about the presentation. The press release and the figures only tell part of the story. Also useful are the extended (prepared) remarks from Tim Cook and CFO, Luca Maestri which are reported by Christine Chan (iMore). There was an expanded version of this from Jason Snell (Six Colors), in which Cook and Maestri fielded questions from the analysts. This is always uninteresting, with the occasional revelation (such as the record sales of Macs) and once or twice in the past some testiness. There was none of that this time. Cook and Maestri made comments about the products and services, adding little snippets on occasion. As ever, they were guarded, particularly when asked about the future. I particularly liked one comment from Cook right at the end when asked about future Health directions. Reading the text it appears almost whimsical: "we can continue to kind of pull the string and see where it takes us." This could apply to many things that Apple does. One of those comments from Cook was that there are now 1.8 billion active devices around the world. That will clearly have an effect on Services in the near and long-term future. In the hours following, the financial analysts grudgingly admitted that Apple had done it again; some noting how the chip shortages that had hit other manufacturers had had less of an effect on Apple: supply chain. Apple's way of organizing its downstream suppliers had reduced the potential damage, with the exception of the iPad, although that still saw sales of $7.2 billion. There was no guidance for the next quarter as has been the case in recent quarters with the Covid uncertainties. The shares did not fall (Wall Street was also happy with Microsoft this week), but sooner or later, we are going to hear the idea, What goes up, must come down. Apple has a few strings to pull before doom sets in. The current share price is just over $170, giving a market capitalisation of $2.78 trillion. Some analysts have revised their predictions to give a $200 price on the stock.

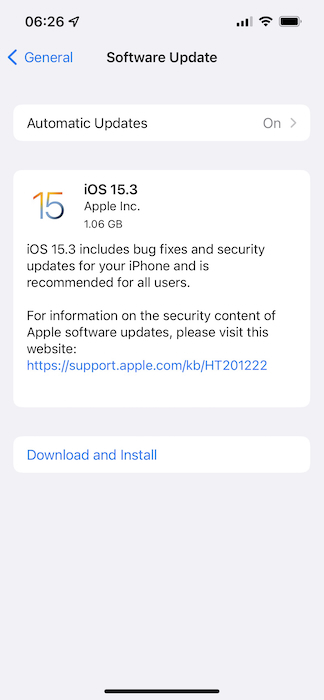

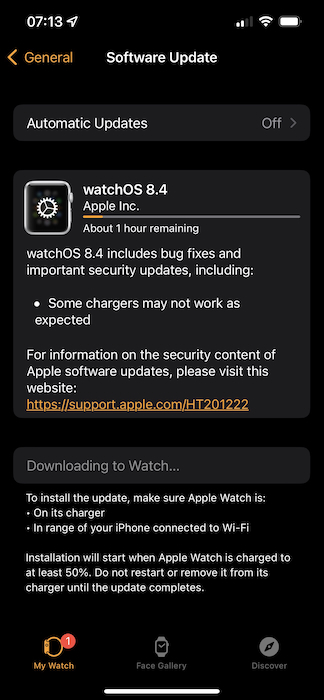

The iOS and iPadOS updates also had fixes for the Safari bug that could reveal a user's browser history. The next morning I saw reports from several sources that the next round of beta releases had begun. It is widely reported that Universal Control, announced last year when the systems were outlined at WWDC, appears to be coming in the next updates. I updated tvOS to 15.3 at the weekend. Apple has had a busy week as, on MacRumors, Juli Clover reports that an "iCloud server issue that was causing some apps that have implemented iCloud support to fail to sync properly" has been fixed. Unrelated apparently is a current iCloud sync problem that some users are experiencing.

With the Wall Street hand-wringing, the price of Netflix shares fell opening up a vulnerability that one savvy investor dived on. Oliver Haslam (iMore) reports that Pershing Square Capital Management bought 3.1 million shares for around $1.1 billion. They immediately saw their investment increase in value by 5%. With 442.5 million shares outstanding, that 3 million or so is less than 1% but it still sends a message.

In his decision there are a number of useful comments from Judge Hildyard. Note, for example, paragraph 63 of the 103 in the judgement. "The VAR strategy was directed by Mr Hussain and encouraged and presided over by Dr Lynch. Both knew that the VAR transactions were not being accounted for according to their true substance. Both knew that the recognition of revenue on the sale to the VAR was improper, and that the accounts were thus false." There were several other comments in the judgement on the dishonest dealings. These include "I have found that both Defendants knew that the accounts and the representations they made in this regard gave a misleading picture of Autonomy's OEM business. They did so because they knew revenues were included from transactions lacking the characteristics associated with OEM business. They knew that such revenues were considered in the market to generate a particularly dependable and valuable revenue stream" (Para 82). And later, ". . . I have reached clear conclusions in these proceedings on the civil liability of Dr Lynch and Mr Hussain for fraud under FSMA, common law, and the Misrepresentation Act 1967, applying, of course, the civil standard of proof of the balance of probabilities" (Para 102). Lynch now faces extradition to the USA for criminal liability but is appealing both the civil case (above) and the extradition order (Paul Sandle and Kate Holton, Reuters). Lynch denies fraud and claims that HP did not understand the technology. More information is available from JDSupra and it is noted that Hussein, Lynch's co-defendant in these proceedings (and former CFO of Autonomy) was last year convicted of 16 counts of securities and wire fraud.

Graham K. Rogers teaches at the Faculty of Engineering, Mahidol University in Thailand. He wrote in the Bangkok Post, Database supplement on IT subjects. For the last seven years of Database he wrote a column on Apple and Macs. After 3 years writing a column in the Life supplement, he is now no longer associated with the Bangkok Post. He can be followed on Twitter (@extensions_th) |

|

There was a lot of fuss from financial analysts this week concerning Netflix which has seen its market share slip. At the same time, Apple has been chipping away at its TV service which, with almost 100% unique content has some advantage, particularly when there is a firm favorite, like Foundation or the highly-regarded MacBeth. Viewers can only see that using the Apple service and that could be a hook to draw them in. Netflix content comes and goes, while also depending on location. Here for example, something in the region of 20% of US content is available. Of course, the price is far less too, but I sometimes feel as if I am missing out.

There was a lot of fuss from financial analysts this week concerning Netflix which has seen its market share slip. At the same time, Apple has been chipping away at its TV service which, with almost 100% unique content has some advantage, particularly when there is a firm favorite, like Foundation or the highly-regarded MacBeth. Viewers can only see that using the Apple service and that could be a hook to draw them in. Netflix content comes and goes, while also depending on location. Here for example, something in the region of 20% of US content is available. Of course, the price is far less too, but I sometimes feel as if I am missing out.